1099-MISC vs 1099-NEC: Differences, 2025 Deadlines & Rules

1099 nec vs 1099 misc forms:

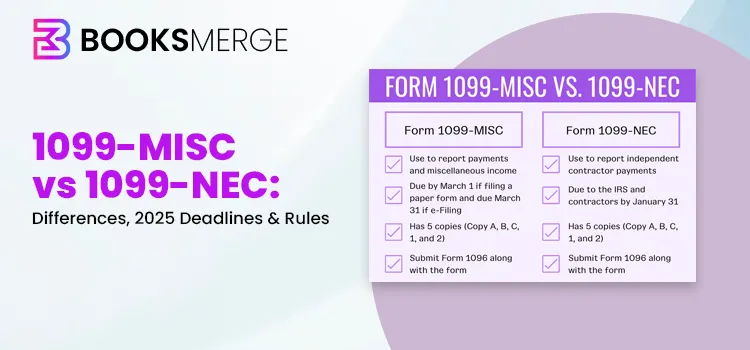

Form 1099-MISC is used for reporting miscellaneous income which includes rent, prizes, and royalties. The Form 1099-NEC is specifically used for reporting non-employee compensation, which includes payments made to independent contractors for services rendered.

Summary:

Form 1099-NEC is used for non-employee compensation, which applies to payments made to freelancers, independent contractors, and other non-employees who are subject to self-employment tax.

Form 1099-MISC is used for miscellaneous income that does not include non-employee compensation, such as rent, prizes, legal settlements, and other non-taxable payments.

If your business paid at least $600 during the year in non-employee compensation to an independent contractor, you will need to file Form 1099-NEC.

If your business paid at least $600 in rent, prizes, or other types of miscellaneous income to an individual or LLC, you will need to file Form 1099-MISC.

Every year, as tax season approaches, the stress and responsibility of businesses increase. Form 1099-NEC and Form 1099-MISC are both important IRS tax forms used to report payments made to non-employees.

It may include the payments given to freelancers, contractors, etc. But, sometimes taxpayers get confused between 1099-MISC Vs 1099-NEC while filing the taxes. So, filing the correct taxation form to the IRS at the right time is important to prevent penalties.

If you want a clearer breakdown of how each 1099s form works year-end reporting, check our complete 1099 form guide that explains deadlines, filling rules, and common mistakes small businesses make

In this post, we have explained the complete details of what the Form 1099-NEC and Form 1099-MISC are and when to file them. Also, we have described the tax penalties you need to pay for missing the deadlines. So, let’s read this post and get a smooth tax filing journey.

The Form 1099-MISC is basically used by the payers for reporting specific types of payments made for miscellaneous income. Moreover, this form is used to report the following payments made throughout the year.

If you have made a payment of at least $10 in royalties or broker payments in the form of dividends or tax-exempt interest.

At least $600 in

Rents are paid except when you pay a real estate agent or property manager.

Prizes and Rewards

Payments to an attorney

Crop Insurance proceeds

Section 409A deferrals

Non-qualified deferrals

Other income payments

Any fishing boat proceeds

Medical and health care payments

Usually, the cash is paid from a national principal contract to an individual, partnership, or estate.

Furthermore, it is essential for businesses to file the Form 1099-MISC for every person from whom they have withheld any federal income tax under the backup withholding rules associated with the amount of payment.

The procedure to file the Form 1099-MISC is quite similar to that of Form 1099-NEC. But, there is some different sections that you must complete for filing the form.

Similar to the Form 1099-NEC, you must obtain the details regarding the recipient’s and payment details. Also, it is essential to obtain a W-9 form from the recipient receiving income. Herein, the W-9 form is used to verify the recipient’s identity and collect the TIN. Besides this, you also need to keep track of your miscellaneous payment details.

You must complete the Form 1099-MISC form, you must enter your details, your recipient’s information and necessary payment details. Then, you must insert the following information in the boxes.

Rents

Royalties

Federal income tax withheld

The fishing boat proceeds

Medical and health care payments

Direct sales totalling $5,000 or more of consumer products to recipient for resale

Substitute payments in placement of dividends or interest

Crop insurance proceeds

Gross proceeds paid to an attorney

Fish purchased for resale

Excess golden parachute payments

Non-qualified deferred compensation

State tax withheld

After this, you must send the Form 1099-MISC with two copies of Form 1099-MISC electronically or physically.

Copy A. This copy goes to the IRS.

Copy B. This copy goes to the recipient.

Herein, make sure that you keep the copies of the records and then send the Form 1099-MISC to prevent the penalties.

The deadline for filing the 1099-MISC form by February 28th if you are filing via mail. For mailing the Form 1099-MISC electronically, file it by March 31st.

The businesses require Form 1099-NEC for reporting the payments made of at least $600 or more to a non-employee. It may include independent contractors, vendors, freelancers, consultants, or self-employed individuals. However, as per the guidelines given by the IRS, the businesses must report the payments on Form 1099-NEC if they fulfill the following conditions.

Payment is made to a person who isn’t your employee

The payment is made for those services in the form of trade or business.

Any payment made to an individual, estate, partnership, or corporation.

If the payments are made to the non-employee, which totals around $600 or more within the calendar year.

Moreover, it is necessary for businesses that the Form 1099-NEC must be filed for each person for whom tax is withheld. However, for reporting the form, the non-employee compensation may comprise commissions, prizes, awards, and other forms of compensation for services done by non-employees.

Perform the following step-by-step instructions to file the Form 1099-NEC.

For filing out the Form 1099-NEC, all you require is a recipient W-9 copy. Herein, the W-9 form provides you with the information you need to fill out the 1099 form. Following are the details that is required by the recipient.

Name

Business entity or relationship (freelancer, proprietor, contractor, business, etc.)

Address

TIN (SSN, EIN, etc.)

For filling out the Form 1099-NEC, insert the business as well the recipient information. Moreover, you also have to enter how much you have paid to the non-employee and how much tax is withheld. Following are the details that you must provide in the 1099-NEC form.

Payer name or business

Payer’s tax information

Recipient’s name or business name

Recipient’s address

Account number (if applicable)

Non-employee compensation

State withholdings (if applicable)

Federal withholdings (if applicable)

You can either send the Form 1099-NEC with a scannable template to the IRS electronically. All you require is to submit two copies of the 1099-NEC that comprises of:

Copy A- This copy must be send to the IRS.

Copy B- This copy is to be send to your contractor or freelancer.

Make sure to keep the copy for your records and then file them timely to prevent the penalties.

Afterwards, according to the your region where you stay, you have to file the form 1099-NEC with the state.

It is essential to send all the copies of the Form 1099-NEC till January 31st of each year for non-employee payments done the previous year.

Herein, we have illustrated the complete table explaining the difference between Form 1099-MISC Vs 1099-NEC.

|

Feature |

Form 1099-NEC |

Form 1099-MISC |

|

1. Definition |

This IRS tax form is used for reporting the non-employee compensation. |

The IRS tax form is used to report the miscellaneous income. |

|

2. Filing Deadline |

You must file this form till 31st January (both paper as well as electronic filing). |

You must file the 1099-MISC form till February 28th if you are doing paper filing. For the electronic filing the due date is 31st January. |

|

3. Who need to file it? |

This form is to be filed by the contractor who paid above $600 in a tax year. |

Whereas, this form is to be paid by an individual or LLC who paid at least $600 during the rent paid. |

|

4. Who can report this form? |

The Form 1099-NEC is used fro reporting the non-employee compensation. |

The Form 1099-MISC is used for reporting specific types of payments beside the wages. |

|

5. Key Payments Reported |

You can report the following payments using this form.

|

You can report the following payments with this form.

|

|

6. IRS penalties for Late filing |

The taxpayer has to pay $60 to $340 per form and maximum up to the ($4,098,500) and ($1,366,000) for the small businesses. |

Herein, the taxpayer has to pay $60 to $340 per form and maximum up to $4,098,500. Moreover, you have to pay ($1,366,000 for small businesses). |

To prevent any mistakes while filing the Forms 1099-MISC and 1099-NEC, you must consider the following things.

You need to file the 1099-MISC form only if you are reporting specific types of payments in addition to wages.

The taxpayers must report the non-employee compensation on the 1099-NEC form only.

Besides this, the taxpayers need to file both 1099-MISC and 1099-NEC forms if they are paying an independent contractor above $600 and $600 in rent.

You don’t have to file either of the two forms if you are paying only for an independent contractor who is paid $300 for the year and not making any miscellaneous payments.

Herein, we have discussed the penalties that you need to pay for incorrect or late filing of the Forms 1099-MISC and 1099-NEC.

In case you miss out the deadline of filing the 1099-NEC form, you need to pay the penalty which varies from $50 to $270 per form. The amount to pay for the penalty may vary how late you submit the form.

Furthermore, if you want some extra time for filing 1099-NEC form, you need to request a filing extension by submitting paper Form 8809. It’s to be filed by January 31st with the IRS. However, you can mail the Form 8809, but it can’t be filed online.

It is necessary to file the Form 1099-MISC appropriately to prevent heavy tax penalities. In order to request for additional time, mail a paper Form 8809 to the IRS by January 31st.

Through this blog, we hope that now you have understood the basic difference between 1099-MISC Vs 1099-NEC. Moreover, it also help you file the taxes on time to prevent the businesses from paying heavy tax penalities.

In case you still require any additional help to file these forms, then you can communicate with our BooksMerge professionals. They will provide you with the best possible assistance to provide you with the stress-free tax filing experience.

The single-member LLC and partnerships usually receive 1099 forms for payments beyond $600. However, you must check your LLC tax status and use the Form 1099-NEC for the services and 1099-MISC for the rent and royalties.

In case you have filed a Form 1099-MISC instead of 1099-NEC, it’s necessary to file a correct 1099-NEC asap to prevent the penalties or fines from the IRS.

You need to report 1099-MISC or 1099-NEC forms only when you have done the payments in the course of any trade or business.

The Self-Employed workers are taxed at 15.3% of 92.35% of the net profit. Herein, this 15.3% is a combination of Social Security (12.4%) and Medicare (2.9%) which is known as FICA taxes.

If you don’t receive a 1099-MISC form, then you are responsible for reporting your income and expenses on your tax return.

Both the 1099 MISC and 1099 NEC forms are used to file the federal and any applicable state tax returns. But, you can’t replace 1099 MISC with 1099 NEC as the MISC form is for miscellaneous income, and the NEC form is for non-employment income.

The Form 1099 NEC is for non-employee service providers like contractors and attorneys. Whereas, Form 1099 MISC is for legal settlements, rent payments.