Bookkeeping

Managing the bookkeeping tasks all alone isn't an easy task for businesses. At BooksMerge, we have trained professionals who will help you streamline complex business operations.

Just a few of the companies we’ve Supported over the years

It's 50/50 people and software—smart tools for instant insights, expert people for strategic guidance. Both working together on your business.

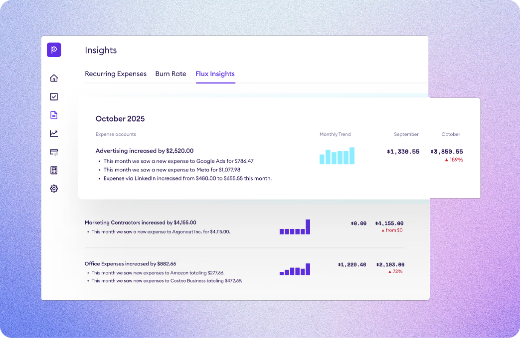

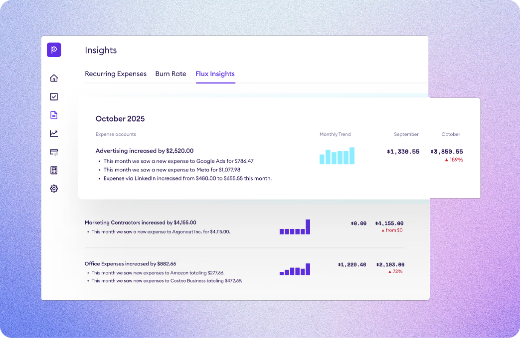

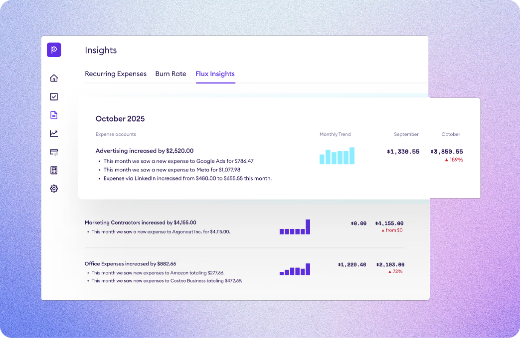

Find the $2,000/month you didn't know you were wasting.

Know if you can afford new hires well before you make the offers.

"Why are sales up but cash flow is down?"

"What happens if we hire two more people?"

"Which expenses are growing faster than revenue?"

Bookkeeping for startups and small businesses, done right. We're not your average accounting firm — we're the largest startup and small business accounting provider in the US. We have unparalleled expertise helping thousands of businesses like yours succeed.

Contact UsYour dedicated team learns your business and connects to your financial data sources, ensuring a tailored approach to your bookkeeping needs and setting the stage for accurate books.

Communicate directly with your team through our user-friendly portal, where you can ask questions and provide feedback on any outstanding items needed to finalize your books every month.

We deliver monthly P&L, Balance Sheet, and Statement of Cash Flow reports that offer insight into your company’s financial health and enable you to make informed decisions. Plus stay up to date with real time account data directly in the portal.

We have bookkeeping and accounting services to support your business at every stage.

Managing the bookkeeping tasks all alone isn't an easy task for businesses. At BooksMerge, we have trained professionals who will help you streamline complex business operations.

Our tax professionals will help you in preparing and filing the company's taxes accurately. Thus, it ensures timely filing to prevent you from paying heavy tax penalties.

Now, you can pay your employees on time as our professionals are there to help you regarding payroll matters. Also, they ensure to process the payroll as per the latest tax table.

Get access to accurate financial reporting to make informed business decisions.

AN IRS CP2000 notice is basically a letter that is provided by the IRS to businesses or individuals ...

Summary • The individual income tax returns must be filed by 15th April. If the date comes on any ...

Running a small business isn’t an easy task for business owners, as they struggle to maintain fina...

The W-2 form is basically for the employee who gets a salary from their Employer for the tasks perfo...

What Is a W-2 Form and Why It Matters in January? A W-2 Form is also known as a Wage and Tax Stateme...

So, the 2026 calnder has started! Recently, taxpayers face a dynamic platform of deadlines, deductio...